#easy forex news

Explore tagged Tumblr posts

Text

What to Expect from Your Forex Trading Tools - Technology Org

New Post has been published on https://thedigitalinsider.com/what-to-expect-from-your-forex-trading-tools-technology-org/

What to Expect from Your Forex Trading Tools - Technology Org

When engaging in the foreign exchange market, having the appropriate tools at your disposal can make a difference. With the forex market operating 24 hours a day, five days a week, it becomes a fast-paced environment. To navigate this landscape effectively and make informed trading decisions, traders must rely on sophisticated forex trading tools. This article will explore what traders expect from these tools regarding their functionality, accuracy, convenience, and support.

Forex, stock market trading – illustrative photo. Image credit: Adam Śmigielski via Unsplash, free license

Functionality: A Comprehensive Set of Essential Features

Tools for Forex trading have an array of features specifically designed to enhance traders’ experience and decision-making abilities. These functionalities are crucial in analyzing market trends, executing trades efficiently, managing risks effectively, and optimizing performance.

Real-time Data Feeds

Among the fundamental functions, forex trading tools offer real-time data feeds, encompassing currency prices, historical data, charts, quotes, news updates, economic calendars, and more. Traders can gain insights into price movements and make better-informed decisions.

Technical Analysis Tools

Advanced charting software integrated into these tools empowers traders with various technical analysis capabilities. From trend lines to Fibonacci retracements and moving averages, these tools provide ways to perform in-depth analysis. Traders can customize indicators and use drawing tools to identify entry or exit points.

Automated Trading

Many trading platforms offer features such as Expert Advisors (EAs) or algorithms. These features enable traders to execute trades based on predefined strategies or conditions as per the trader sets.

Accuracy: Reliable Data for Informed Trading Decisions

Accurate data plays a significant role in trading, as even minor discrepancies can significantly impact trade execution and market evaluation. Forex trading tools excel at providing up-to-date information.

Order Execution

A reliable trading tool ensures swift order execution, minimizing the chances of slippage or requotes. Advanced platforms offer access to market liquidity providers, reducing latency in trade execution.

Historical Data Validation

Access to historical data is crucial for backtesting strategies and analyzing past performance. Forex trading tools provide data traders can rely on to validate their approach.

Convenience: Accessible and User Friendly Platforms

A proficient forex tool offers functionalities and focuses on providing a great user experience. These tools make trading activities easier for traders, eliminating the need for added effort or dealing with complexities.

Intuitive User Interface

Forex trading tools have an easy-to-use interface that caters to beginners and experienced traders. With navigation, personalized layouts, customizable dashboards, and presented information, these tools ensure a seamless trading experience.

Mobile Support

Flexibility is crucial in the fast-paced forex market. Trading tools that offer support through applications enable traders to monitor the market, conduct analyses, and execute trades.

Support: Assistance When You Need It

Traders may inevitably face challenges or have queries while using trading tools. Having prompt and dependable customer support is invaluable to ensure seamless trading operations.

Technical Support

A notch forex tool provider offers round-the-clock support for any platform-related issues or inquiries a trader might encounter during their trading journey.

Educational Resources

Traders can significantly enhance their skills and knowledge base through various training materials. These resources include video tutorials, webinars, articles, and access to a community.

Conclusion

Trading tools greatly facilitate successful trades in the market. These tools offer functionalities that provide accurate data feeds for decision-making, convenient access through user-friendly interfaces, and reliable support when needed. Evaluating your requirements before selecting the right trading tool that aligns with your trading goals is crucial, as this will ultimately contribute to your success in the forex market.

#Algorithms#Analysis#applications#approach#Article#Articles#charts#Community#comprehensive#data#data validation#easy#economic#Environment#excel#Experienced#Features#Fintech news#Forex#Fundamental#insights#issues#it#Landscape#latency#materials#Mobile#monitor#navigation#News

0 notes

Text

Title: "Gen Z Hustle: How Side Gigs and Digital Innovation are Shaping Kenya's Youth Culture"

Introduction In the bustling streets of Nairobi, young Kenyans are busy making their mark in innovative ways that go beyond traditional careers. The rise of digital technology and Kenya’s rapidly evolving economic landscape have cultivated a unique “side-hustle culture” among Generation Z, who are actively reshaping work, community, and creativity. From influencing on social media to e-commerce and even venturing into cryptocurrency, these young hustlers are defining a new Kenyan dream that is all about resilience, creativity, and financial independence.

Side-Hustles in the Age of Social Media One of the most prominent changes in Kenya’s youth culture is the significant shift from relying solely on formal employment to embracing digital side hustles. On Instagram, Twitter, and TikTok, young Kenyans are building personal brands as influencers, marketers, and content creators. This trend is largely driven by the power of social media platforms, where personalities like Azziad Nasenya and Flaqo have transformed social media virality into flourishing careers.

Platforms like TikTok and Instagram allow young Kenyans to reach broad audiences with content that resonates—comedy skits, motivational videos, makeup tutorials, and dance challenges. With brands now recognizing the influence of digital personalities, many Kenyan influencers are finding opportunities to collaborate with companies for product endorsements and advertisements. These partnerships bring a sense of visibility and empowerment that has been less accessible in traditional industries.

For 24-year-old David Mwangi, a content creator and social media strategist, the allure of influencing lies in its accessibility and potential for growth. “You don’t need a big budget to get started; you just need creativity,” he explains. David’s experience reflects the sentiment of many Gen Z Kenyans who see social media not just as a pastime but as a pathway to sustainable income.

The E-commerce Boom and the Rise of Small Online Shops In addition to influencing, e-commerce has become a major outlet for Kenyan youth looking to earn extra income. Platforms like Jumia, Kilimall, and Facebook Marketplace provide easy avenues for young entrepreneurs to start online businesses, selling anything from thrifted clothes and beauty products to locally made crafts and accessories. Kenya’s mobile payment system, M-Pesa, has also simplified transactions, allowing e-commerce to thrive even without widespread use of credit cards.

With rising unemployment rates and limited job opportunities, many young Kenyans are using digital tools to build businesses from scratch. Some youth groups have formed collectives to sell items in bulk, often buying directly from manufacturers or importing from abroad to resell at a profit. This trend, known locally as biashara za mtaa (local businesses), has created a bustling informal economy that operates largely online.

For 23-year-old Aisha Ahmed, the journey started with a Ksh 5,000 loan from her older brother. Now, she runs an online shop that specializes in selling affordable, stylish handbags through Instagram. “People think starting a business requires a lot of capital, but what really matters is finding something people need and building a brand around it,” she says.

Crypto, Forex, and the Financial Revolution Another intriguing aspect of Kenya’s Gen Z hustle culture is the growing interest in cryptocurrency and Forex trading. Although controversial, the allure of quick profits and financial independence has drawn many young people into these new financial frontiers. Kenya’s tech-savvy youth have quickly adapted to apps like Binance and Paxful, learning the intricacies of cryptocurrency trading and often mentoring each other online.

Crypto’s appeal among Gen Zers lies in its promise of empowerment and financial freedom—an opportunity to circumvent traditional banking systems. However, the lack of regulation and high risks involved have left many young Kenyans facing steep learning curves and financial losses. Despite the volatility, online communities and forums dedicated to Forex and crypto trading continue to grow, attracting young people with a “high risk, high reward” mentality.

Karanja, a 22-year-old business student, views crypto as a game-changer: “It’s the future of money,” he asserts. He has spent months learning about blockchain technology and considers it a long-term investment. Karanja’s experience highlights the optimism surrounding digital currency in Kenya, despite the risks and controversies.

Challenges Facing the Digital Hustlers While side-hustle culture has opened new opportunities, it comes with significant challenges. The competitive nature of digital influencing and e-commerce can be cutthroat, with many young people finding it hard to stand out. Mental health issues, such as stress and burnout, are becoming common among young hustlers as they juggle multiple gigs alongside their education or formal jobs.

For those in crypto and Forex, the risks are even higher. Cases of scams and Ponzi schemes have left many young investors in debt, leading some to lose faith in the industry altogether. The lack of regulation around cryptocurrency also means that youth are vulnerable to fraudsters, who often take advantage of their desire for quick financial gains.

The New Face of the Kenyan Dream Despite the challenges, side-hustle culture has become a defining feature of Gen Z in Kenya. This trend signifies a shift in how young Kenyans view success, replacing the traditional path of formal employment with a vision that values independence, innovation, and adaptability. It’s a cultural revolution rooted in digital innovation, resilience, and the determination to succeed on their own terms.

For Kenyan youth, the hustle is more than just a means to an end—it’s a way to redefine their place in society. As Aisha puts it, “It’s not just about making money; it’s about taking control of your future.”

4 notes

·

View notes

Text

Tevau Visa U Card - make your dollar spending more free and convenient!

Rock-Solid Security

Our advanced wallet system ensures top-tier protection for your assets.

Play by the Rules

Respecting local regulations and continuously applying for necessary licenses.

KYC & AML

Strictly complying with KYC and AML regulatory requirements.

🚀 Enjoy unlimited, premium free🚀

Get up to $25,000 free with your Visa U card! Whether you're shopping online, traveling overseas or making daily purchases, it's easy to cope without worrying about the burden of additional costs.

💳 ATM withdrawals, rate transparency 💳

Need cash? No problem! The Tevau Visa U card provides you with convenient ATM cash withdrawal service. Only 1.9 percent of fees are charged, compared to the industry average of 2 percent.

💳 Transparent signing fee, easy to grasp 💳

There are no signing fees for default currency transactions. For non-default currency transactions, only 1.2% forex fees are charged, so you can easily keep track of fees when you spend around the world.

🚀 Free transaction fee 🚀

The Tevau Visa U card provides you with free transaction fees. Whether it is online shopping, offline consumption or money transfer, you do not have to pay any transaction fees. Let you save worry and effort, enjoy convenient payment.

💰 High limit to meet your needs 💰

Whether it isa single purchase or a lifetime purchase, the Tevau Visa U Card provides you with a high limit protection. With a single purchase limit of up to $150,000 and an industry average of $100,000, you can spend your dollars more freely.

📱 APP easy to query, at any time 📱

The Tevau Visa U card also provides convenient APP query service. You can view transaction records, balance information and other information at any time through our APP, so that you can keep track of account dynamics at any time.

🌍 Waived worldwide mailing fees, Express card 🌍

The Tevau Visa U Card also provides you with a worldwide waived mailing fee, making it easy to apply for and receive your Visa U card no matter where you are. Physical cards can be delivered as soon as the next day, so you don't have to wait too long to enjoy the convenience of your Visa U card.

💖 Start a new era of spending in dollars with your Visa U card💖

Apply for a Visa U card today and let's start a new era of dollar spending! Whether it's for travel, shopping or everyday purchases, the Visa U Card is your indispensable companion. Let's enjoy a convenient, efficient and safe US dollar spending experience together! End benefits: Find me to open a card has a discount!

🎉 Apply for your Tevau Visa U card now! As an open card benefit, any user who applies to open a card through me can enjoy additional benefits. Please contact me or check Tevau official website for specific offers.

💡 Let's start a convenient journey of global payments!

🚀 Fill in invitation code 683650 when registering Or copy the address below

https://tevau.io/invite_registration/#/?inviteCode=683650

Card promotion code: QJFYQC

2 notes

·

View notes

Text

Which is Better: Forex, Crypto, or Stock? A Deep Dive into Prop Firm Tech

INTRODUCTION

The financial landscape is constantly changing, and with new changes comes the production of more choices than ever for traders. The most common include Forex, cryptocurrency, and stock trading. Each market has special characteristics and advantages but carries difficulties, so the emergence of prop firm tech allowed trading to become more accessible and efficient. In this blog, we will be talking about the pros and cons of

Forex, crypto, and stock trading and how prop firm tech can enhance your trading experience.

Underlying the Markets

Forex Market

Forex represents the world’s largest financial market, referring to that market where currency trades occur.

High Liquidations: Forex offers a level of liquidation that is high. Its trading volumes exceed $6 trillion, allowing the traders to comfortably enter and leave positions. Forex is traded 24 hours a day on weekdays, thus offering ample convenience for the traders.

Leverage: Most Forex brokers are highly leveraged. This means that a trader controls much larger positions with lesser capital.

Challenges despite the advantages:

The leverage might create a highly volatile currency price and the highest risk it causes is that it is an effect of its highly volatile nature.

There is an overwhelming complexity in managing economic indicators, and there are geopolitical factors too, which are not easy to handle for new traders.

Crypto Market

The crypto market is trading in digital currencies such as Bitcoin, Ethereum, and more than 5,000 altcoins.

Benefits:

Volatility: The crypto market is volatile. Within a very short duration, one can gain tremendous returns.

Decentralized: With cryptocurrencies, there is a decentralized peer-to-peer network so that no banks are used to monitor transactions.

It is open: All it needs is an internet connection to create opportunities with this kind of market, and it reaches across the globe.

Regulatory Risks: The regulation of the crypto market is not well-established, so it is an uncertain area.

Security Risks: Crypto space is highly prevalent with hackers as well as scams. Hence, the traders must beware of the same.

Stock Market

Definition: the stock market represents an entity where shares of publicly traded companies are traded

Benefits

Governance and Transparency: Since the stock market is very well governed, it offers some kind of security for investors.

Dividends: Most stocks pay dividends thereby ensuring that the investor earns some income from the shares.

Research and Analysis: There is much information to make stock analysis hence helping the traders come to a conclusion.

Drawbacks

Market Hours: the stock market only operates within fixed hours thereby limiting trading.

Lesser Volatility Stock prices often exhibit much slower movements in comparison to Forex and crypto price swings, potentially leading to reduced profit margins.

Prop Firm Tech: Revolutionizing Trading

There has always been a high level of diversity in markets, and for this reason, prop firm tech has emerged as the real deal. Proprietary firms provide capital to traders while engaging them with the latest technology to enhance their trading strategy.

This is how prop firm tech is revolutionizing the game of trading:

Access to Capital

Prop firms also enable traders to gain access to significant capital, thus they can take bigger positions and can hence gain larger profits. Such is truly rewarding for Forex and crypto traders who may not have that much money required to trade even in the best possible way.

Sophisticated Trading Platforms

Proprietary trading firms invest in advanced trading technology that gives traders cutting-edge platforms offering a high level of data provision, sophisticated charting tools, and automated trading features. This tech can significantly enhance the trading experience across Forex, crypto, and stocks.

Risk Management Tools

Prop firm tech also features powerful risk management tools, which can help in minimizing the trader’s loss and ensure the safety of capital. Such tools are quite essential in volatile markets like Forex or even cryptocurrencies, whose prices tend to change rapidly.

Education and Training

Alarge number of prop firms offer educational resources, mentorship, or training for the development of a required skill base by the traders. Support is highly important to any new traders entering Forex, crypto, or even the stock market.

Community and Networking

Trading with a prop firm usually involves trading with other people. This facilitates several things: you will have to have a community of fellow traders, exchanging insights and ideas, strategies you’re implementing, and support you give someone else.

Feature | Forex | Cryptocurrency | Stock Market

Liquidity | High | Varies by asset | High (for major stocks)

Volatility | Moderate to High | High | Moderate

Trading Hours | 24/5 | 24/7 | Limited (specific hours)

Leverage | High | Varies | Low to Moderate

Regulation | High | Low (still evolving) | High

Education | Available (varied by broker) | Limited (varies widely) | Extensive (research available)

Technology | Advanced prop firm tech available | Emerging tools | Established trading platforms

Conclusion

Is Forex, cryptocurrency, or stock trading the best?

The above question doesn’t have a definitive answer, since each market has specific positives and negatives suited to different types of trading. However, with the help of rising prop firm tech, the tools and resources available to every trader can improve trading experiences across all markets.

If you are looking for high liquidity and flexibility, Forex may be the choice. For people who seek high returns and have no fear of volatility, then cryptocurrency may be the way to go. Meanwhile, for those wanting a more regulated environment with an abundance of readily available research, stock trading may be the way to go.

Based on which one is best depends on the trading style of the individual, his risk tolerance, and preferences, you could consider your options while maximizing your trading potential with the benefits of prop firm tech, irrespective of the market.

#proptech#forex prop firms funded account#fxproptech#prop firms#best prop firms#funded#prop trading firms#funded trading accounts#my funded fx#best trading platform#propfirmtech

2 notes

·

View notes

Text

Effortless Mobile Forex Trading in 2024: A Beginner's Guide

Ever thought you could make money from anywhere, anytime, with just a few clicks on your phone? Well, stop imagining because this dream can become a reality with mobile forex trading. Do you really need a desk or a fancy trading setup to start trading in the forex market? Absolutely not!

With a smartphone and a stable internet connection, you can trade currencies from the palm of your hand—whether you’re at home, standing in line, or on a beach vacation. Stick with us as we break down the steps to start forex trading on your phone in 2024, even if you’re a complete newbie.

What is Mobile Forex Trading?

Mobile forex trading is exactly what it sounds like—buying and selling currencies using an app on your smartphone. It offers the flexibility to manage trades, monitor the market, and execute orders wherever you are. Unlike traditional trading, which might require a desktop setup or multiple screens, mobile trading puts the power of the forex market right in your pocket.

Getting Started: Your Gateway to Mobile Trading

The first step in your mobile trading journey is selecting a broker with a strong mobile platform.

Select a trading app that fits your needs including MetaTrader, cTrader, DxTrade, and TradingView are great options.

Download the app and sign up. Verify your identity and link your trading account to get started.

Within minutes, you’ll be ready to start trading. Most apps allow you to customize your dashboard, making it easy to focus on the information that matters most to you.

Why Choose Mobile For Forex Trading in 2024?

In 2024, mobile forex trading has become an essential tool for modern traders as it offers unparalleled convenience and flexibility. Trading on a smartphone means you can engage with the forex market from virtually anywhere—whether you're at home, commuting, or on vacation.

This freedom allows for real-time access to market updates and trade execution, ensuring you never miss out on critical opportunities. Mobile trading apps are designed to be user-friendly, providing an intuitive interface that simplifies complex trading tasks, making it accessible for both beginners and experienced traders.

Additionally, these apps offer advanced features such as push notifications for market alerts and integrated tools for technical analysis, which help you stay informed and make timely decisions. The ability to manage your trades on the go aligns perfectly with today's fast-paced lifestyle, making mobile forex trading not just a convenience but a necessity for staying ahead in the dynamic world of forex.

Common Mobile Trading Challenges:

Limited visibility on small screens can make it difficult to analyze detailed charts and manage multiple trades simultaneously.

Unintentional touches on a touchscreen can result in accidental trades or errors.

Battery life can drain quickly with intensive trading apps.

Security risks are higher with mobile trading.

Too many notifications can be distracting.

Mastering Your Mobile Trading App Like a Pro:

Explore and Learn: Take full advantage of tutorials, guides, and any available training materials to become proficient with the app.

Practice Regularly: Use a demo account to get comfortable with the app’s features and trading functions.

Optimize Your Settings: Adjust the app’s settings to fit your trading style and preferences. This includes notification settings, chart configurations, and trade preferences.

Stay Updated: Keep up with app updates and new features. Developers often release updates that improve functionality and fix bugs.

Develop a Routine: Establish a consistent trading routine to help you stay organized and make the most of the app’s features.

Conclusion:

Mobile forex trading in 2024 is easier and more accessible than ever before. With just a smartphone, you can tap into the forex market from anywhere in the world, managing trades, analyzing the market, and executing orders with just a few taps.

Whether you’re a beginner or looking to take your trading to the next level, mobile trading offers the flexibility and tools to succeed. So why wait? Get a trading app today and start your mobile forex trading journey!

#forextrading#forex education#Mobile Trading#Best Forex Trading App#forex trading strategies#forex trading signals

2 notes

·

View notes

Text

Unchain Your Website's Potential: The Ultimate Guide to VPS Hosting!

Is your website sluggish, unreliable, and constantly battling for resources? Shared hosting might have been a lifesaver when you were starting out, but now it's holding you back. Upgrading to a Virtual Private Server (VPS) can be the game-changer you need. But what exactly is a VPS, and how can it unleash your website's true potential?

This comprehensive guide dives deep into the world of VPS hosting, explaining how it works, its benefits for tasks like Forex trading, and the key factors to consider when choosing the perfect plan for your needs. We'll even show you how to navigate the setup process and unlock the power of your VPS with tools like Remote Desktop Protocol (RDP).

By the end of this article, you'll be armed with the knowledge to confidently choose a reliable VPS hosting provider like Data Base Mart and propel your website or application to new heights of performance and security.

Unveiling the VPS: How It Works

Imagine a high-rise apartment building. The entire building represents a physical server owned by a hosting provider. Now, imagine dividing each floor into individual, self-contained units. These units are your VPS!

VPS hosting leverages virtualization technology to carve a single physical server into multiple virtual ones. Each VPS functions like a dedicated server, with its own operating system, software, and allocated resources like CPU, memory, and storage. This isolation ensures your website or application enjoys a stable environment, unaffected by activity on other virtual servers sharing the physical machine.

How VPS Hosting Works

VPS hosting builds upon the core principle explained above. Hosting providers like Data Base Mart offer various VPS plans with different resource allocations. You choose a plan that aligns with your needs and budget. The provider then sets up your virtual server on their physical infrastructure, granting you root access for complete control and customization.

Powering Forex Trading with VPS

Foreign exchange (Forex) trading thrives on speed and reliability. A VPS ensures uninterrupted access to the market, even during peak trading hours. With a VPS, you can run trading bots and automated strategies 24/7 without worrying about downtime caused by shared hosting issues.

Choosing the Right VPS

Selecting the ideal VPS hinges on your specific needs. Here's a breakdown of key factors to consider:

Resource Requirements: Evaluate your CPU, memory, and storage needs based on the website or application you'll be running.

Operating System: Choose a provider offering the operating system you're comfortable with, such as Linux or Windows.

Managed vs. Unmanaged: Managed VPS plans include maintenance and support, while unmanaged plans require you to handle server administration.

Scalability: If you anticipate future growth, choose a provider that allows easy scaling of your VPS resources.

How to Use VPS with Remote Desktop Protocol (RDP)

Many VPS providers offer remote access via RDP, a graphical interface that lets you manage your server from a remote computer. This is particularly useful for installing software, configuring settings, and troubleshooting issues.

Creating a VPS Account

The signup process for a VPS account is straightforward. Head to your chosen provider's website, select a plan, and follow the on-screen instructions. They'll typically guide you through the account creation and server setup process.

VPS Pricing

VPS plans are generally more expensive than shared hosting but significantly cheaper than dedicated servers. Pricing varies based on resource allocation and features. Providers like Data Base Mart offer competitive rates for reliable VPS solutions.

VPS Terminology Explained

VPS Stands For: Virtual Private Server

VPS Airport (doesn't exist): VPS is not an airport code.

VPS in Basketball (doesn't exist): VPS has no meaning specific to basketball.

VPS Hosting: As explained earlier, refers to a hosting service that provides virtual private servers.

VPS in Business: In a business context, VPS can refer to a virtual private server used for web hosting, application deployment, or other IT needs.

VPS in School (uncommon): While uncommon, schools might use VPS for specific applications requiring a dedicated server environment.

Final Thoughts

VPS offers a compelling middle ground between shared hosting and dedicated servers. It provides the power and control of a dedicated server at a fraction of the cost. By understanding how VPS works and choosing the right plan, you can unlock a secure and reliable platform for your website, application, or even Forex trading needs.

#How Do Vps Work#How Does Vps Work#How Does Vps Work In Forex Trading#How Does Vps Hosting Work#How Are Vps Chosen#How To Vps Rdp#How To Vps Account#How To Vps Price#What Does Vps Stand For#What Does Vps Airport Stand For#What Does Vps Mean In Basketball#What Does Vps Hosting Mean#What Does Vps Stand For In Business#What Does Vps Stand For In School#How Much Does Vps Cost

2 notes

·

View notes

Text

How to Short Forex: Short Selling Currency Details

This article explores the basics of short selling forex, using the EUR/USD currency pair as an example to explain the steps involved. It also advises on suitable risk management throughout the trade journey.

What does short selling currencies involve?

The term ‘short selling’ often confuses many new traders. After all, how can we sell something if we don’t own it?

This is a relationship that began in stock markets before forex was even thought of. Traders that wanted to speculate on the price of a stock going down created a fascinating mechanism by which they could do so.

Traders wanting to speculate on price moving down may not own the stock they want to bet against; but likely, somebody else does. Brokers began to see this potential opportunity; in matching up their clients that held the stock with other clients that wanted to sell it without owning it. The traders holding the stock long (buy position) can be doing so for any number of reasons. Perhaps they have a low purchasing price and do not want to enact a capital gains tax.

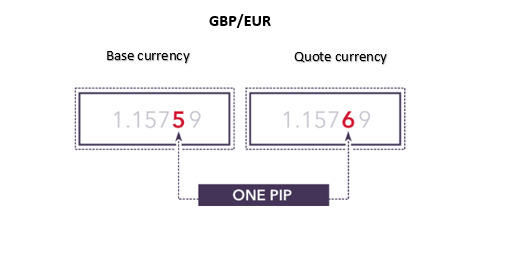

How to short forex: EUR/USD short selling example

Taking a short position in forex involves understanding currency pairs, trading system functionality and risk management.

First, each currency quote is provided as a ‘two-sided transaction.’ This means that if you are selling the EUR/USD currency pair, you are not only selling Euros; but you are buying dollars. Because of this, no ‘borrowing,’ needs to take place to enable the short sale. As a matter of fact, quotes are provided in a very easy-to-read format that makes short-selling more simplistic.

Want to sell the EUR/USD?

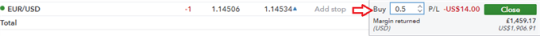

Easy. Just click on the side of the quote that says ‘Sell.’ After you have sold, to close the position, you would want to ‘Buy,’ the same amount (if you end up buying at a lower price than where it was sold, you would end up with a profit — excluding commission and fees). You could also choose to close a partial portion of your trade.

For example, let’s assume we initiated a short position for $100 000 and sold EUR/USD when price was at 1.29.

If the price has moved lower, the trader could realize a profit on the trade (excluding commissions and fees). But let’s assume for a moment that our trader expected further declines and did not want to close the entire position. Rather, they wanted to close half of the position to cover the initial cost, while still retaining the ability to stay in the trade.

Our trader, at that point, would have realized the price difference on half of the trade (50k) from their 1.29 entry price to the lower price they were able to close on. The remainder of the trade would continue in the market until the trader decided to buy another 50k in EUR/USD to ‘offset,’ the rest of the position.

How to manage the risk of short selling currencies

Short selling forex carries high risk as there is no maximum loss on a trade. Losses are unlimited, as forex values can theoretically increase to infinity. On a long (buy) trade, the value of a currency can never fall below zero which provides a maximum loss level.

Managing risk on accounts was a trait we discovered with successful traders. Fortunately, there are ways to mitigate this short selling risk:

Implement stop losses.

Monitor key levels of support and resistance for entry/exit points.

Stay up to date with the latest economic news and events for potential downside risk.

Employ price alerts on trades is a good way to stay informed when you’re away from your platform. Price alerts are mobile/email notifications that update traders when certain price levels are reached on a specific market. These price alerts can be predetermined to suit the traders key levels.

Short selling forex is preferred for down trending markets, however careful consideration is required before trading as it brings extra risk even with a bearish outlook. It has been utilised by large institutions/traders as hedges, or by traders looking to trade descending markets. Risk management is essential for proper application, and the methods mentioned in this article should be given the utmost consideration as adverse movements in price can be detrimental.

Further reading recommendations

Many forex traders have significant experience trading in other markets, and their technical and fundamental analysis is often quite good. However, this is not the case 100% of the time. Take a look at What is the Number One Mistake Forex Traders Make? for more insight.

Successful trading requires sound risk management and self-discipline. Find out how much capital to risk on your open trades.

We host multiple webinars throughout the day, covering a lot of topics related to the Forex market like central bank movements, currency news, and technical chart patterns being followed.

To get involved in the large and exciting world of forex check out our Forex for beginners trading guide.

#financialservices#forextrading#gambit#marketing#youtube#forexbot#accounting#forex online trading#wealthmanagement#forex

2 notes

·

View notes

Text

How to earn $300 per day ?

There are many ways to earn $300 per day, but the specific method that will work best for you depends on your skills, interests, and resources. Here are a few ideas:

Freelancing: Freelancing is a great way to earn money, especially if you have specific skills like writing, graphic design, web development or social media management. You can join freelance sites like Upwork, Fiverr or Freelancer and offer your services to potential clients. With a steady job and a good reputation, you can quickly earn $300 a day.

Online Tutoring: If you have expertise in a particular subject, you can offer online tutoring services. You can join a training website or offer your services on platforms like Craigslist, Facebook or Instagram. Many students are looking for qualified teachers who can teach them in the comfort of their own homes. With a good reputation and regular customers, you can easily earn $300 a day.

Affiliate Marketing: Affiliate marketing is a method of earning commissions by promoting other people’s products or services. You can join affiliate networks like Amazon Associates, ClickBank or Commission Junction and promote your products on your blog or social media channels. With enough traffic and conversions, you can easily earn $300 a day.

Trading: Trading is another way to earn money if you have some experience and knowledge about the stock market, Forex or cryptocurrencies. You can start with a small investment and gradually increase your investment as you gain more experience. With consistent trading you can easily earn $300 a day.

Online surveys: Online surveys are a quick and easy way to earn some extra cash. You can sign up to survey sites like Swagbucks, Survey Junkie or InboxDollars and complete surveys whenever you want. Although the pay is relatively low, you can still earn $300 a day if you complete enough surveys.

Blogging: Blogging is a long-term strategy that requires consistent effort, but it can be a lucrative source of income. You can start a blog in a specific niche and monetize it through advertising, affiliate marketing or selling your own products. With enough traffic and a loyal following, you can easily earn $300 a day.

Do you know to earn $300/day in next few days — -Get Access to FREE Video Showing You New Method to Earn $300/day.

In short, earning $300 a day takes effort, commitment, and dedication. There are several ways to earn this amount, but you need to find one that suits your skills and interests. With persistence and hard work, you can reach your financial goals and live a comfortable life.

How can i earn money from home without investment ?

2 notes

·

View notes

Text

Is forex broker Clark Financial Advisory reliable?

This article contains the following information:

The most important information about Clark Financial Advisory;

Is Clark Financial Advisory a scam?

How do I get started with Clark Financial Advisory?

More detailed information about the brokerage organisation;

All modern brokerage terminals by and large have the necessary set of options, if we are not talking about all sorts of sophisticated options for technical analysis, used by scalpers and other categories of traders. It's not about the economic news and so on. Today, the main criterion for evaluating the excellence of a trading platform for newbies is its usability and intuitiveness. All the major functions such as getting price information, tools for market analysis, deal management, account management, instrument testing and tactics analytics are applied without any glitches. By the way, this can be said not only about the basic version of the platform, but also about the version for mobile phones and tablets. The website is also quite handy and has all the important information on it. We have not noticed any weaknesses. The same evaluation criteria apply to brokerage firm websites as to brokerage terminals and Clark Financial Advisory's website meets them, it is simple and intuitive.

Withdrawals

Judging by the reviews on Clark Financial Advisory, withdrawals are done without any difficulty. At least we didn't find that on any of the sites we looked at reviews on. After speculating on forex with Clark Financial Advisory we sent a withdrawal request and the money was transferred in about twenty-four hours. A repeat withdrawal yielded similar results. This is very very cool when you consider that the average withdrawal time from a brokerage company is a couple of times longer.

Overall, the process of registering and starting to trade is not very different from other companies. One needs to go through the identity verification procedure by uploading the usual package of documents. The minimum amount to start trading is also standard - $250. At the time of writing, broker Clark Financial Advisory provides four insured trades and access to a standard range of instruments in a beginner's package with a minimum deposit.

Trading experience with forex broker Clark Financial Advisory

We have been trading through Clark Financial Advisory for three weeks. For the most part it was trading in the foreign exchange market. We tested the signals that Clark Financial Advisory gives on forex. We did not collect statistics, but in general the ratio of profitable to loss-making trades was in favor of profitable ones. In addition, we watched how Clark Financial Advisory managers talk to us. We monitored whether they would use unfair practices, for example when offering investment solutions scammers often use the technique of creating urgency, i.e. the scammer claims that the option will be available for a couple of minutes and then will be irrelevant for some reason. In the end we did not see such things. Often even white brokers do not give any important information about their investment solutions, they do not tell us about additional commissions, dangers, their strategy and so on. Fortunately we have not noticed any of the above. For this reason, in this review of Clark Financial Advisory we claim that it is without a doubt a white company.

Features of Clark Financial Advisory broker

Apparently Clark Financial Advisory is client-oriented and therefore in its approach to investor communication, the broker aims to ensure that it allows clients the opportunity to earn and makes the trading process as easy as possible. Here are the advantages and disadvantages of forex broker Clark Financial Advisory:

Key information.

Clark Financial Advisory has been operating since 2013. Legal incorporation in the UK. Has a standard package of documents. In the stock market, commodities and foreign exchange markets, the broker offers work with the usual range of instruments. The number of cryptocurrencies available to trade through Clark Financial Advisory is larger than the average spectrum. Clark Financial Advisory updates its platform on a regular basis.

Clark Financial Advisory platform overview

In this part of the article information about:

What's good about the Clark Financial Advisory platform

The main requirement for brokerage platforms

Reviews on Clark Financial Advisory

We said above that the reviews on the broker are mostly positive, so here's just a mention of what the reviews most often discuss and about the ratio of favorable to critical reviews. The ratio of good to bad reviews at Clark Financial Advisory is somewhere around 5 to 1 in favor of the good. This ratio holds true on all review sites, including well-known ones like Trustpilot and Sitejabber. The point of the praise reviews can be boiled down to these things:

Good service and analytics;

The brokerage company sends effective signals;

No serious problems from interacting with the broker for a long time.

What does it take to work with forex broker Clark Financial Advisory?

Benefits of Clark Financial Advisory

customer focus;

Regular updates of our trading platform; Large selection of trading instruments;

Fast execution of orders;

Competent support service;

No hidden fees;

Is Clark Financial Advisory a scam? Without a doubt not. To start with, as it was written above, Clark Financial Advisory has all the required licenses in place. That's more important than anything else. It is also important, that we ourselves have checked Clark Financial Advisory and realized, that it is an honest company, which fulfills its obligations, providing a quality service and Clark Financial Advisory professionals are not trying to deceive traders and take their deposits one way or another. Generally, we all understand how many different kinds of scams there are at the moment, and how to recognize them. In recent years, many criminals charge huge hidden fees and rig slippages. Trading forex with Clark Financial Advisory we have not observed any of this. Opinions are also a very important parameter. Reading the reviews on Clark Financial Advisory we found the standard reviews on a white brokerage firm. People talk about their experience of trading signals etc.

A more detailed review of Clark Financial Advisory

In the next part of the material there is information about:

The forex experience with Clark Financial Advisory;

Comparison of how the managers of Clark Financial Advisory are contacted versus how the scammers do it;

Overview of Clark Financial Advisory's platform

Weaknesses of Clark Financial Advisory

No zero commissions Typical minimum deposit Limited number of instruments available for clients with minimum deposits.

2 notes

·

View notes

Text

How the fuck will that get you cancelled?

That is the most uncancellable, milquetoast shit I have ever seen.

If you start saving at 30 years old and you expect to retire at 65 and use $100k/year until 85 you have to invest $3000/month

Thats fucking nuts. I am putting that much away. Its insane

Here are some that will get you cancelled:

If you have good enough credit to get a $42,000 credit card and preferably like $100k credit card you could (if you made it your full time job) make $30 mil/year

Rental properties are priced based on revenue, not property value. This can be exploited both ways

A car payment should not be more than 8% of your income

A house should cost twice your salary but with a 30 year mortgage 4x your salary is affordable

Its almost impossible to sell a house thats 5x the average income in a town. So in a town with “average” income $60k per person a $300k house will need to be on the market for 6 months or more. Most nice/suburban towns have average incomes above $100k.

Banks have just cut mortgages and business loans to 90% of what it was in 2008. So were pretty fucked

You first house (with the first time home buyers program) can have a down payment of 3-5%. Its okay to not do 20%

If you’re poor places with low cost of living are more important than taxes. Virginia have high taxes but at $15/hr it doesn’t matter. you can get cheap rent and food and fuel there.

Buying a home is a scam by the banks

Refinancing your home is a scam

Refinancing your debt WITH ANOTHER BANK is not always a scam. They get your business instead of the other guys.

If you refinance with the same bank they have no incentive to help you and, in fact, have an incentive to fuck you

You will die poor

Warren Buffet invests in shit businesses and props them up by lobbying for government regulation that makes him more profitable like the Keystone pipeline. You cannot invest like Warren Buffet no matter what some book says and if you could, you shouldn’t

You can’t beat an index fund. Other people can. I do. You can’t

FOREX is actually straight up gambling. The “brokers” control the prices. Arguably its more fun than gambling but just be aware

You don’t “need” that new thing

Lifestyle creep will ruin your finances

Unless you are actively trying Costco and Sam’s Club will not save you money. Its pretty easy to do it right though

Some things are actually more expensive at Walmart than at the fancy grocery stores

You should be going to 2 or 3 different stores to get your stuff for less

Don’t buy super cheap stuff. Its a waste of money

Sometimes it is cheaper to eat out because you will have a lot of food waste and meal prep sucks. The only thing I like to prep is soup.

Most jobs have an economic impact 3 to 4x the actual pay. Get over it. The company doesn’t make that much.

Banks won’t lend to independent contractors

Net worth is not comparable to actual cash in hand

$25k is a reasonable amount to keep in the bank as. A rainy day fund. With minimum account amounts on high interest savings accounts $30k is actually reasonable. Yeah I know the average american has less than $1k

If you live in a place that has slightly above average rent and food costs the living wage is like $18.75 or more

When bond interest rates reverse that means rich people and banks are buying 30 year bonds and not 5 year bonds. This is not financial advice but thats when I am eyeballing those 5 year bonds. Banks are forced to buy bonds when the Federal Reserve “prints” money. They choose 30 year bonds even though they are a terrible investment.

If you are going to buy bonds consult an advisor. There are ways to time the market and times when inflation adjusted bonds aren’t the best so yes you do actually need to talk to someone knowledgable

The best investors are paid commission. They make money when you make money so their interests are aligned with yours

Vending machines, laundromats, and other side hustles are a scam. They are a waste of your precious time. Just work overtime at your job or grow cash crops like Oyster mushrooms

You don’t have enough money to get into real estate or most of those side hustles anyway. Minimum is like $150k cash

Oh and if you do manage to build wealth your children or grandchildren will waste it and be wage slaves again

31K notes

·

View notes

Text

2025's Leading Forex Brokers

Success in 2025 depends on selecting the top online Forex trading platforms. Industry leaders that provide first-rate services and features can be found among the leading Forex trading firms. Strong tools and resources will be offered by the top Forex trading firm. Forex trading applications for beginners are easy to use and instructive for individuals who are new to the market. The first step in starting a trading career is learning how to open a Forex trading account.

suggest broker

1 note

·

View note

Text

Best Forex Broker for Beginners

Choosing the Best Forex Broker for Beginners: A Comprehensive Guide

When stepping into the world of forex trading, selecting the right broker can be the most critical decision you'll make. For beginners, it's essential to find a platform that combines user-friendly tools, competitive trading conditions, and reliable customer support. In this guide, we’ll explore how to identify the best forex broker for beginners, what to look for in the best trading conditions forex broker, and why QuoMarkets.com stands out among top forex brokers.

Why Choosing the Right Forex Broker Matters

Forex trading is one of the most dynamic financial markets, offering opportunities to trade 24/7 with immense liquidity. However, without the right broker, you may face challenges like high fees, poor trading tools, or lack of proper guidance. This is why choosing a broker tailored to your needs as a beginner is paramount.

Features of the Best Forex Broker for Beginners

1. User-Friendly Platforms

Beginners need intuitive platforms that simplify trading. Features like customizable dashboards, easy order placements, and demo accounts are essential. QuoMarkets.com offers a highly accessible platform designed to make your trading experience seamless.

2. Comprehensive Educational Resources

Knowledge is power in forex trading. The best brokers provide tutorials, webinars, and market analysis. At QuoMarkets.com, beginners can access extensive educational resources to help them understand forex trading fundamentals.

3. Low Initial Deposit and Fees

Many beginners hesitate to commit large sums upfront. QuoMarkets.com provides competitive account options with low initial deposits and transparent fee structures, making it ideal for new traders.

4. Robust Customer Support

Forex trading operates in real-time, and technical or account issues can’t afford delays. QuoMarkets.com’s 24/7 multilingual customer support ensures help is always at hand.

Identifying the Best Trading Conditions Forex Broker

Trading conditions significantly impact your potential profitability and overall experience. Here are key factors to evaluate:

1. Low Spreads

Lower spreads mean reduced costs for traders. QuoMarkets.com is known for offering some of the tightest spreads in the industry, ensuring maximum value for your trades.

2. High Leverage

While leverage can amplify profits, it’s crucial to use it wisely. The best brokers offer flexible leverage options. QuoMarkets.com allows traders to customize their leverage settings to suit their risk appetite.

3. Fast Execution Speeds

In forex trading, seconds matter. Delayed order execution can lead to losses. QuoMarkets.com boasts ultra-fast execution speeds to ensure your trades are placed without delays.

4. Variety of Trading Instruments

A good broker provides access to various currency pairs and other financial instruments. QuoMarkets.com offers a broad range of trading options, including forex, commodities, and indices.

Why QuoMarkets.com Is a Leading Forex Broker

QuoMarkets.com has emerged as a trusted name in the forex trading community, especially for beginners. Here’s what sets it apart:

1. Tailored for Beginners

QuoMarkets.com is designed to help novice traders confidently navigate the forex market. With intuitive tools and resources, it’s the perfect starting point for anyone new to trading.

2. Top-Notch Security

Security is a non-negotiable aspect of online trading. QuoMarkets.com prioritizes the safety of client funds and personal information with advanced encryption and regulatory compliance.

3. Multiple Account Types

Whether you're a beginner or an experienced trader, QuoMarkets.com offers account types that suit your needs, including demo accounts for practice.

4. Award-Winning Platform

QuoMarkets.com’s trading platform has been recognized for its ease of use, advanced charting tools, and superior functionality, making it one of the best options among forex brokers.

Tips for Beginner Forex Traders

1. Start Small

Don’t rush into trading with large amounts. Use demo accounts to practice and gain confidence.

2. Educate Yourself

Take advantage of educational materials provided by brokers like QuoMarkets.com to build a strong foundation.

3. Set Realistic Goals

Forex trading is not a get-rich-quick scheme. Focus on steady learning and gradual growth.

4. Manage Risks Wisely

Always use stop-loss orders and never invest more than you can afford to lose.

Conclusion

Choosing the best forex broker for beginners is the first step toward a successful trading journey. With a focus on providing the Best Trading Conditions Forex Broker experience, QuoMarkets.com stands out as a reliable and beginner-friendly option. Whether you're just starting or looking for a trustworthy broker, QuoMarkets.com offers the tools, resources, and support needed to thrive in the forex market.

Ready to start your trading journey

Contact us:

Phone Contact No

Contact No: +35725123894

0 notes

Text

🚀 How Ginitrade AI Helps Beginners Succeed in Forex Trading

👨🏫 New to Forex? Ginitrade AI is your perfect trading companion!

✅ Intuitive Interface: Easy-to-use setup for beginners.

✅ Demo Account: Test your strategies risk-free.

✅ Education & Guidance: Learn as you trade with Ginitrade’s resources.

✅ Automated Trading: Focus on strategy while Ginitrade handles execution.

👉 Start your trading journey with confidence and let Ginitrade help you grow your skills. 🌱 🔗 https://ginitradeai.com/

#ForexTrading#AITrading#GinitradeAI#BeginnersGuide#SmartTrading#AutomatedTrading#FinancialFreedom#LearnToTrade#ForexSuccess

1 note

·

View note

Text

Tech Surge: Microsoft & Foxconn Spark Forex Shifts Tech Takes the Wheel: The Hidden Opportunities in Equity Markets European equities found their groove today, cruising into positive territory—except for the FTSE 100, which seems to have taken a scenic detour. What’s fueling this rise? It’s tech, baby. From Foxconn’s record-breaking revenue to Microsoft’s jaw-dropping $80 billion AI investment, tech stocks are leading the charge and lighting up portfolios faster than a Black Friday sale. But hang on—there’s more to this story than meets the eye. Behind these headlines are hidden patterns and contrarian plays that could redefine your trading game. Let’s break it down. Foxconn’s Record Q4: Lessons for Forex Traders Foxconn, the tech giant best known for manufacturing iPhones, has posted a record-breaking Q4 revenue of $64.7 billion, up 15% year-over-year. While consumer electronics stayed flat, AI servers drove this growth, signaling a tectonic shift in tech demand. Hidden Gem Insight: The takeaway here isn't just about tech stocks. For Forex traders, this trend can ripple into currency pairs tied to tech-heavy economies like USD/JPY or USD/TWD. Strong AI server demand could boost Taiwan's dollar or lead to tech-export surges impacting USD/Asia trades. Microsoft’s $80 Billion AI Bet: A Currency Crossroads Microsoft isn’t playing small ball. Its $80 billion plan to expand AI-capable data centers is a moonshot that could create ripples across tech, equity, and even Forex markets. More than half of this budget is earmarked for the U.S., which could strengthen the dollar as capital flows surge into domestic investments. Actionable Tip: Watch the DXY index. A robust USD could pressure EUR/USD and GBP/USD lower while boosting USD/JPY. AI is no longer just tech jargon—it’s a forex catalyst. Emerging Trends: What Forex Traders Need to Know - Tech-Driven Currency Correlations: Currency pairs linked to tech-heavy economies are seeing increased volatility. Think USD/JPY or USD/TWD. - Contrarian Moves in Safe Havens: As tech booms, traditional safe-haven currencies like CHF or JPY could lose their appeal, presenting short opportunities. - AI Infrastructure Boom: Countries investing heavily in AI infrastructure (think USD and EUR) could see currency appreciation. Trade Smarter, Not Harder It’s easy to get swept up in tech hype, but smart traders dig deeper. Foxconn’s AI server growth hints at shifting global tech demand, and Microsoft’s AI investment is poised to fuel economic growth stateside. Pair these insights with a contrarian eye for safe-haven trades, and you’re not just following the news—you’re rewriting it to your advantage. —————– Image Credits: Cover image at the top is AI-generated Read the full article

0 notes

Text

Learn Forex Trading with Dollar Dex Academy

Are you curious about forex trading but don’t know where to start? Forex trading, also known as foreign exchange trading, can seem complex at first, but with the right guidance, it’s a skill anyone can learn. That’s where Dollar Dex Academy comes in – a platform designed to make forex trading easy to understand and accessible for everyone.

What Is Dollar Dex Academy?

Dollar Dex Academy is a learning platform that teaches you everything you need to know about forex trading. Whether you're a complete beginner or someone looking to sharpen your trading skills, the academy provides lessons and resources to help you trade confidently.

At Dollar Dex Academy, the focus is on making forex trading simple. The lessons break down complex topics into easy-to-follow steps, ensuring you don’t feel overwhelmed.

Why Learn Forex Trading?

Forex trading offers several benefits:

Accessibility: You can start trading with minimal resources from the comfort of your home.

Flexibility: The forex market operates 24/5, giving you the freedom to trade at your convenience.

Earning Potential: With the right knowledge and strategy, forex trading can be a rewarding way to grow your finances.

However, trading without understanding the basics can lead to losses. That’s why learning the right skills is essential, and Dollar Dex Academy is here to guide you through the process.

What You’ll Learn at Dollar Dex Academy

Dollar Dex Academy offers a range of lessons to equip you with the knowledge and skills to succeed in forex trading. Here’s what you can expect:

Forex Basics: Learn the fundamental concepts of forex trading, including how currency pairs work, what market trends mean, and how to read charts.

Risk Management: Understand how to minimize losses and protect your investment by using effective risk management techniques.

Trading Strategies: Discover simple yet effective trading strategies that you can use in real markets.

Market Analysis: Learn to analyze the market using tools like technical indicators and fundamental data to make informed trading decisions.

Practical Tips: Get practical advice on avoiding common mistakes, improving your trading mindset, and staying disciplined in your trades.

Who Is It For?

Dollar Dex Academy is for anyone interested in forex trading. It doesn’t matter if you have no prior experience or if you’ve tried trading before and found it difficult. The academy’s lessons are easy to follow and structured in a way that anyone can understand.

Why Choose Dollar Dex Academy?

There are many reasons to choose Dollar Dex Academy for your forex trading journey:

Easy-to-Understand Content: The lessons are straightforward, using simple language to explain even the most complicated topics.

Flexible Learning: You can learn at your own pace, making it ideal for those with busy schedules.

Real-World Focus: The strategies and techniques you learn are designed to work in real trading scenarios.

Supportive Environment: You’ll have access to resources and tips that help you stay motivated and confident as you learn.

Start Your Journey with Dollar Dex Academy

Forex trading doesn’t have to be intimidating. With the right education and guidance, anyone can become a confident trader. Dollar Dex Academy is here to support you every step of the way, helping you gain the skills and knowledge needed to navigate the forex market.

Start your journey with Dollar Dex Academy today and take the first step toward achieving your trading goals. Whether you want to earn extra income, grow your savings, or explore a new skill, Dollar Dex Academy makes learning forex trading simple and effective.

Final Thoughts

Forex trading is a powerful tool for financial growth, but success comes with knowledge and practice. By joining Dollar Dex Academy, you can avoid the pitfalls of trading blindly and instead build a strong foundation for a successful trading journey.

Take the leap and discover the world of forex trading with Dollar Dex Academy – where learning meets success!

#forextrading#forex education#forex expert advisor#forex market#onlineclasses#learntotrade#DollarDexAcademy#LearnForex#TradingSkills

0 notes

Text

maximize your profits with Coinrule Automated trading bots!

Maximize Your Profits with Coinrule Automated Trading Bots!

Coinrule is a leading platform that lets users create trading strategies without coding. It's great for both newbies and seasoned traders. With Coinrule's bots, you can avoid emotional trading, make trades smoothly, and watch the market less. This way, you can better manage your investments and increase your profits in the fast crypto world.

Coinrule's easy-to-use interface and many pre-built strategies make it perfect for all traders. Its ability to create custom rules without coding is unique. With Coinrule, you can focus on improving your strategies, not getting lost in coding.

Key Takeaways

Coinrule's automated trading bots allow users to create custom trading strategies without coding knowledge

The platform offers a wide range of pre-built strategy templates and technical indicators

Coinrule integrates with over 10 major cryptocurrency exchanges, including Binance and Coinbase

The platform provides a demo exchange for testing strategies with virtual funds

Coinrule's automated trading bot operates 24/7, ensuring constant monitoring and execution of trading strategies

The platform includes risk management tools like stop-loss, take-profit, and trailing stop orders

Understanding Automated Trading Bots in Cryptocurrency Markets

Automated trading bots have

changed how we trade in cryptocurrency markets. They use algorithms to make trades based on set strategies. This helps traders stay disciplined, trade better, and avoid emotional trading.

With more people trading crypto, these bots are getting more popular. They offer faster, more efficient, and consistent trades than manual methods.

Coinrule's automated trading bots help users in the complex world of cryptocurrency trading. They use algorithmic trading to boost trading performance. No coding trading is needed, making it easy for all traders.

Increased efficiency and consistency

Reduced time and effort

Automated execution based on predetermined rules and strategies

Automated trading bots help traders grab market chances and make trades quickly and efficiently. They reduce emotional trading. Whether you're new or experienced, these bots can help you reach your crypto market goals.

How Coinrule Transforms Your Trading Experience

Coinrule's platform is easy to use and offers many customizable options. It's perfect for traders at any level. You can make your own trading plans, watch market trends, and trade with precision. Plus, you get to use technical analysis tools to understand market data and spot trends.

In the world of cryptocurrency trading, having the right tools is key to success. Coinrule's platform has features like real-time market watching, smart triggers, and a template library for quick setup. These help traders fine-tune their strategies and boost their trading success.

youtube

Improved trading performance through automated trading strategies

Enhanced risk management with features like stop-loss orders and trailing stops

Increased efficiency with automated trade execution and real-time market monitoring

By using Coinrule's platform and features, traders can change their trading game. They can get better results in the cryptocurrency trading market. Feature Benefit Automated Trading Strategies Improved trading performance and increased efficiency Real-time Market Monitoring Enhanced risk management and timely trade execution Template Library Quick start and easy customization of trading strategies The Power of No-Code Trading Strategies

Coinrule lets users make custom trading rules without coding. This makes it simple for traders to automate their forex and crypto investments. The platform has a library of templates to help users get started quickly. It also has tools to improve their strategies over time.

Automated trading bots are getting more popular in forex and crypto markets. They let traders make money 24/7. Coinrule's bot works in real-time, watching market changes and acting fast. This helps traders make the most profit.

Using Coinrule's no-code strategies has many benefits. Traders can define conditions for bot execution and set actions like buying or selling. They can also use logical operators to link different conditions. This customization lets traders create strategies that fit their needs and goals.

With Coinrule's bots, traders can diversify their investments across many strategies. This reduces risk and boosts profit chances. The platform also has tools like stop-loss and take-profit to help manage risk and maximize gains.

Real-Time Market Monitoring and Smart Triggers

Coinrule lets you stay ahead with real-time market monitoring and smart triggers. You can watch market trends, spot chances, and trade quickly. The smart triggers help you set rules for trades to happen automatically, so you don't miss out.

Using coinrule for trading has many benefits:

Execute trades with precision and speed

Analyze market trends and identify opportunities

Set custom rules and execute trades automatically

Coinrule's platform is easy to use and customize. Its simple interface lets you create and trade with confidence. Feature Description Real-time market monitoring Analyze market trends and identify opportunities Smart triggers Set custom rules and execute trades automatically Customizable options Create and execute trades with precision and speed Supported Exchanges and Integration Features

Coinrule works with big exchanges like Binance, Coinbase, and Kraken. This makes trading safe and secure. With automated trading bots, you can trade confidently. Your trades are on trusted exchanges, and your investments are safe.

Setting up your account is easy. Coinrule's no coding trading lets anyone create trading rules without coding. This makes it easy for all traders.

Major Exchange Partnerships

Coinrule has partnerships with big exchanges. This gives users lots of trading options. Key features include:

Secure and reliable trading environment

Fast and efficient trade execution

Access to a wide range of trading pairs

Security Protocols and Safety Measures

Coinrule focuses on security and safety. It has measures to protect your account and trades. These include:

Advanced encryption technology

Secure API connections

Regular security audits and updates

Account Connection Process

Connecting your account to Coinrule is easy. With automated trading bots and no coding trading, you can trade with confidence. Exchange Trading Pairs Security Measures Binance 100+ Advanced encryption, secure API connections Coinbase 50+ Regular security audits, secure API connections Kraken 200+ Advanced encryption, secure API connections, regular security audits

Creating Your First Automated Trading Strategy

Coinrule's platform makes it easy to start with crypto trading. It has a user-friendly interface and many features. You can create a trading strategy that fits your needs.

To start, use Coinrule's algorithmic trading tools. These tools help you analyze market data and spot trends. This way, you can make smart trading choices and increase your profits in crypto trading.

Some key features of Coinrule's platform include:

Template library for quick start

Strategy optimization tools

Customization options for parameters like price movement and amount to be sold

Coinrule doesn't need coding skills, making it easy for all traders. Its user-friendly interface and features make it great for your first algorithmic trading strategy. Feature Description Template Library A range of pre-built strategies to get you started Strategy Optimization Tools Tools to analyze market data and identify trends Customization Options Options to customize parameters like price movement and amount to be sold Risk Management Features and Portfolio Protection

Coinrule's platform offers tools to help you manage your investments and reduce losses. It's key to have a good trading strategy in place. With Coinrule, you can set up and use trading strategies that fit your goals and how much risk you're willing to take.

In forex trading, managing risk is very important. Coinrule has many risk management tools, like stop-loss, position sizing, and diversification. These tools help you control how much you risk and can prevent big losses.

Key Risk Management Features

Stop-loss implementation: Set custom stop-loss levels to limit possible losses

Position sizing controls: Manage your trade size and risk exposure

Diversification tools: Spread your investments across different assets to reduce risk

Using Coinrule's risk management tools and portfolio protection, you can trade with confidence. Your investments are safe, and your risk is low. Whether you're experienced or new, Coinrule gives you the tools to do well in trading strategies and forex trading. Feature Description Stop-loss implementation Set custom stop-loss levels to limit possible losses Position sizing controls Manage your trade size and risk exposure Diversification tools Spread your investments across different assets to reduce risk

Advanced Trading Techniques with Coinrule

Coinrule's platform offers advanced trading tools to help traders make more money. It uses automated trading bots for creating and executing custom strategies. The platform also has pre-built strategies like scalping and trend following, based on technical analysis.

Some of the key features of Coinrule's platform include:

Multi-condition rules for precise entry and exit points

Trailing Stop Loss and Take Profit to protect gains and limit losses

Backtesting of trading strategies against historical data to minimize risks

A wide range of pre-built template strategies, including "The Combination Scalper" and "Catching The Bottom"

Coinrule's platform is easy to use, even for those without no coding trading skills. It has a demo exchange with virtual money, letting users test strategies safely.

Using Coinrule's tools, traders can outperform others in the market. They can craft their own strategies and trade with precision. This way, they can increase their profits and stay on top in cryptocurrency trading.

Performance Analytics and Strategy Optimization

Coinrule's platform offers tools for improving trading strategies. It helps users analyze their trading history to spot trends. This way, they can make better decisions for future trades. The ROI tracking tools let users keep an eye on their returns and tweak their strategies as needed.

Some key features of Coinrule's tools include:

Trading history analysis to identify trends and patterns

ROI tracking tools to monitor returns and adjust strategies

Strategy backtesting features to test and refine strategies before executing them in live markets

These tools help traders boost their profits and stay on top in cryptocurrency trading. Coinrule makes it easy for traders of all levels to create and optimize their strategies.

Coinrule's tools are vital for traders aiming to enhance their strategies and earnings. Its easy-to-use interface and powerful features make it ideal for traders seeking to elevate their game. Feature Description Trading History Analysis Analyze past trades to identify trends and patterns ROI Tracking Tools Monitor returns and adjust strategies as needed Strategy Backtesting Features Test and refine strategies before live market execution

Getting Started: Pricing Plans and Features

Coinrule offers various pricing plans to fit different trading needs. There's a free plan and several paid options with extra features. The free plan is perfect for starting with automated trading bots and seeing how no coding trading works in the crypto world.

The paid plans, like Starter, Hobbyist, Trader, and Pro, come with more advanced tools and strategies. For instance, the Hobbyist plan has 40 template strategies. The Trader and Pro plans offer unlimited strategies.

Here's a look at the pricing plans and what they offer: Plan Template Strategies Supported Exchanges Priority Customer Support Free 7 Up to 5 No Starter 7 Up to 5 No Hobbyist 40 Up to 10 Yes Trader Unlimited Up to 10 Yes Pro Unlimited Up to 10 Yes

Coinrule's plans cater to all traders, from newbies to pros. With automated trading bots and no coding trading, traders can boost their profits in the crypto market.Conclusion: Elevate Your Trading Game with Coinrule

Coinrule's platform helps traders improve their trading strategies and increase profits. It uses automated trading bots to make trading smoother and more logical. This way, you can avoid letting emotions guide your decisions.

More and more traders are choosing Coinrule for its top-notch features. It's perfect for both experienced and new traders. Coinrule offers an easy-to-use interface, strong risk management tools, and detailed analytics to help you reach your financial targets.

Using Coinrule's cutting-edge tech can lead to big profits and less emotional trading. It keeps you on top of the fast-changing crypto markets. Start using Coinrule's automation to boost your trading skills today.

FAQ

What are Coinrule's automated trading bots?

Coinrule's automated trading bots use algorithms to make trades. They follow set strategies. This helps traders stay disciplined and avoid emotional trading.

How does Coinrule's platform transform the trading experience?

Coinrule's platform is easy to use. It lets traders customize their strategies and use technical analysis tools. It also has many features to help succeed in crypto and forex markets.

What are Coinrule's no-code trading strategies?

Coinrule's no-code strategies let users create custom rules without coding. They use a template library and strategy tools to do this.

How does Coinrule's real-time market monitoring and smart triggers work?

Coinrule's real-time monitoring lets users track market trends. They can set custom rules and smart triggers. This ensures they don't miss trading opportunities.

What exchanges does Coinrule support, and how does it ensure security?

Coinrule supports big exchanges like Binance, Coinbase, and Kraken. It ensures a safe trading environment with strong security measures. These protect user investments.

How can I get started with creating my first automated trading strategy on Coinrule?

Starting with Coinrule is easy. It has a user-friendly interface and step-by-step guides. There's also a template library to help you begin.

What risk management and portfolio protection features does Coinrule offer?

Coinrule offers tools for managing risk. It has stop-loss, position sizing controls, and diversification tools. These help users protect their investments and reduce losses.

What advanced trading techniques and tools are available on Coinrule?

Coinrule has technical analysis tools and algorithmic trading. It also offers advanced features. These help traders increase profits and stay competitive.